10 simple Steps for Starting Exports from India

- Saurabh Pandey

- Apr 17, 2023

- 11 min read

Updated: Aug 19, 2023

Exporting Goods and Services from India is still a dream for many, but it's just because of the lack of Knowledge about the Technical Terms related to export.

Indian Export has done well in FY 2021-22, it touched the figure of USD 676.2 BN of Exports (exported the good of Value USD 421.8 BN & exported services of USD 254.4 BN) which is an all-time high. In FY 22-23, the Indian government has taken an even more thrusty target of USD 800 BN which includes both Merchandise and Services Export.

In a press conference, Mr. Piyush Goyal (Minister of Consumer Affairs, Food & Public Distribution) quoted the projection of Indian export will be reaching 2 trillion by the year 2030. it gives a clear indication that Indian Government going to take massive action, to promote export from India.

But how can you become part of this aspiring growth journey, How you can start your Export Firm in the Year 2023. let us give you step-by-step guidance to start your export firm.

Table of Content

Introduction.

1) What is Export?

In Simple Language, export is the process of selling products or services from one country to another country, it can be done with adjacent countries to your border or with countries based on a different side of the globe.

2) How to start Exporting from India?

For Starting, Exporting from India you should follow the below step.

Step 1) First and Foremost you should have a product. A product about which you should have complete knowledge or in the case of service you should have the expertise to serve your customer well.

Step 2) For starting Export you should have your firm registered, having its PAN, GST number, IEC (Import Export Code), and Current Bank Account in an Internationally recognized Bank so that it can take payment in USD, Euro, GBP, JPY & other currencies.

Many agencies can help you to register your company at a cheaper cost like India Filing, Startupwala, and quick company

Step 3) Get found online by getting a domain, Creating your website, and having an official Email address. Because the Global Customer wants to see you on the web and it helps you to build your authenticity. You can Get the domain by Godaddy, Bluehost, Wix, and Hostinger.

Step 4) Get your RCMC (Registration cum Membership certificate) and AD (Authorized Dealer Code). RCMC helps avail authorization to export by the Indian Government through different bodies like the Concerned Export Promotion Council (EPC)/FIEO(Federation of Indian Export Organizations)/Commodity Board. which also enables you to avail of the benefits or concessions under FTP 2015-20.

3) What are the Documents required to start your export agency?

To start your export agency you need to have certain documents which will be either one-time or multiple-time payments.

3.1 ) Set up your firm:- By setting up your company you complete your first step. but first, you have to choose what type of company you want to start. A company registration may cost you Rs. 3500 to Rs 9000 approximately, which is a one-time investment, but for completing the government compliances you need to pay a certain amount which completely depends on the no. of transactions you do in a financial year,

There are 4 types of companies that you can register to start your export business

Sole Proprietorship:- A Sole Proprietorship is an enterprise that. is wholly controlled by one person. There is no formal registration required under Sole Proprietorship.

Partnerships:- In a partnership firm, two or more people come together to form a company. There is a partnership deed that specifies the invested interest of each partner and their profit-sharing is also divided as per the agreed investment structure. it's easy to raise funds in a partnership firm.

Limited liability partnerships (LLPs):- LLP firm allows you to take the advantage of both the corporation and partnership business structures. It allows for a partnership structure where each partner’s liabilities are limited to the amount they put into the business.

Private Limited Company:- A private limited company is a company that needs to be a minimum of two directors and 15 directors. it is the best form of a company that builds authenticity for your customer. but it has more compliances to fulfill than any other type of company mentioned in the above list.

3.2) Get a Pan Card:- After Registering your firm the first thing you will have is to get your PAN card. Every exporter has to get, a PAN from the internal revenue service. PAN card helps you to get known to the Banks which built unique identity numbers for the Indian financial system.

3.3) Open the Current Bank Account:-You need to get a current bank account in a bank that deals in foreign currencies so that you can easily get your transactions done with your customer.

3.4) Get your GST (Goods and Services Tax) number:- GST number is the most essential part of your business, it not only built authenticity and enables you to pay taxes but also allows you to avail benefits like the seamless flow of Input Tax Credit (ITC) on their raw material purchases. Every business providing goods or services, or both, that has a turnover exceeding Rs 20 lakh has to have the GST number. mandatory.

3.5) Get the IEC Code:- The Importer-Exporter Code is a unique identification number provided by the DGFT (Director general of foreign trade) which may cost you Rs 500. you can simply apply for the IEC code by going on DGFT's official website, and by following simple steps you may get your IEC code for one year, then next year you again have to apply for a retainer ship of the IEC number.

Note: Your GST must be Linked with your IEC code for a smooth transition.

4) How to do the product analysis?

It is the most important thing one must do before starting to think about the export business, you should have a detailed analysis of the product. if in case you don't have the product in your hand you may also trade it from someone in India and easily export it to a customer based in a different country. but finding a perfect quality product is a big problem for you as well as for your customer.

If you are a manufacturer or farmer or service provider you must be having all the knowledge about your product, & its quality, but in the case of trading you need to have all the quality certifications of the product which you are going to export, you should have detail insight about its required quality parameters, its profit margins, you should also be aware of the best market to get the product in India as well in out of India. so that you can understand your competition.

5) What is RCMC, and How to get the RCMC?

RCMC (Registration cum Membership certificate) is the certificate provided by the Indian government bodies like the Concerned Export Promotion Council (EPC)/FIEO(Federation of Indian Export Organizations)/Commodity Board. Indian Government has formed a total of 33 Bodies that will help you in exporting your product this certificate generally works as a support function for your export business as it has some major key benefits

1) RCMC helps you to avail the benefits of the policies like EPCG Export Promotion Capital Goods (EPCG) Scheme, and exemption of bank guarantee under Advance Authorization, etc.

2) After getting a member of the Concerned EPC by availing RCMC, You get multifold opportunities to showcase your products on multiple platforms like Trade fairs, B2B meetings & other promotional events organized by EPC.

3) EEPC supports you to get all kind of consultancies for all your trade-related issue, also time to time give you insight and future upcoming technologies which may help you to trade in a better way. it also enables exporters to avail benefit like the reimbursement of their flight fares to attend the international trade fare.

6) What is an AD Code How do Get the AD code?

An AD (Authorized Dealer) Code is a 14-digit code that is given by the bank where the exporter opened his business current account. it is a mandatory document for export as while generating the shipping bill for export customs clearance, Without an AD code registration, a shipping bill cannot be generated. as an AD code gives the authentication that the transaction which the exporter is going to make is completely legal.

7)How do Find a Genuine Buyer?

The biggest concern faced by all the experts is to find a genuine buyer as in many cases fraud happens with the exporter due to which they start thinking that exporting goods is not their cup of tea and they stop their business due to losses. but with the following way you may find a genuine buyer without spending money.

The most efficient and organic way to get a buyer is from B2B websites. By registering your website and product on Portals like India Mart, Alibaba, and Exports India you can attract buyers to your website.

The second most efficient way to get genuine buyers is by just google it, and doing email marketing, of your product and company. try to find the countries over google where your product has a huge demand. Try to find the best companies who are dealing in the same product in that country, they may be your potential customer.

The Third but little expensive way to get a genuine buyer for your product in the international market is attending trade fares related to the product you are dealing in. Also with the help of the EPC (Export Promotion council) you may easily get a part of the delegation for the event which is going to happen in other countries by following some simple steps.

A genuine buyer always deals in genuine payment terms (On LC and Advances), which gives you a surety about his genuineness.

8) What is sampling, and how it should be done for Buyers in Export?

Sampling is the process by which a buyer gets agreed to buy the product based on commercial agreements, Once you find a buyer, the first thing would be asked to have is your product samples, for sampling your need to be very precise in packaging, because the sample is the first step to convincing your buyer about the quality of your product.

Make sure that the sample is properly sealed and has your branding on it to make it more authentic. After getting the approval from the buyer, payment term and Inco term finalization should be your first step.

Type of payment terms the shipper should be agreeing to.

The first payment term in the list is 100% advance before shipment, this is the most satisfactory payment term on which an exporter should work, as he gets the payment before dispatch of the shipment. the payment term is completely risk-free but in this case, you should also be loyal towards your commitment and ship the shipment to the buyer on the agreed time plan.

Certain % advance rest after Scanned BL this the also a good payment term to work on with the Buyer, under this payment term you get a certain % of the payment as an advance on your Proforma Invoice, and the rest you may get on sending the scanned BL (Bill of Landing or Airway bill). , the original copy must be held by you as if the buyer tries to fraud he can not avail the original BL to get released the shipment in his customs (for Example 30% advance rest on scanned BL)

Letter of Credit is the third most favorable payment term for an exporter, as in Later of credit the shipper gets an assurance of payment from the buyer's bank, LC is a bank guarantee from the buyer's bank, after shipping the shipment and on agreed LC terms when the shipper produces the same to his bank the payment gets credited from buyers bank to shipper bank.

Type of Inco terms the shipper should be agreeing to

Ex Works (EXW) is an international trade term that describes when a shipper makes his product available on his premises, and the buyer bears the cost of transportation from the shipper location to the desired buyer's location.

FOB is an international trade term that describes when a shipper makes his product available on an agreed Sea/AIR/ ICD port of the shipper's county of origin. in this shipper need to take care of the freight from the shipper location to the shipper's nearest port or at the agreed port of the buyer in the shipper's county of origin.

C&F Cost and Freight is an international trade term that describes under which the shipper (seller) has to bear the costs and freight to transport the goods to the port of destination of the Buyers country. the insurance of goods in transit is not part of this incoterm agreement.

CIF Cost Insurance Freight is an international trade term that describes under which the shipper (seller) has to bear the costs, Goods transit insurance & freight to transport the goods to the port of destination of the Buyers country.

After negotiating well on your desired payment and Incoterms, you should ask the buyer to share the PO and proceed with the production or arrangement of goods.

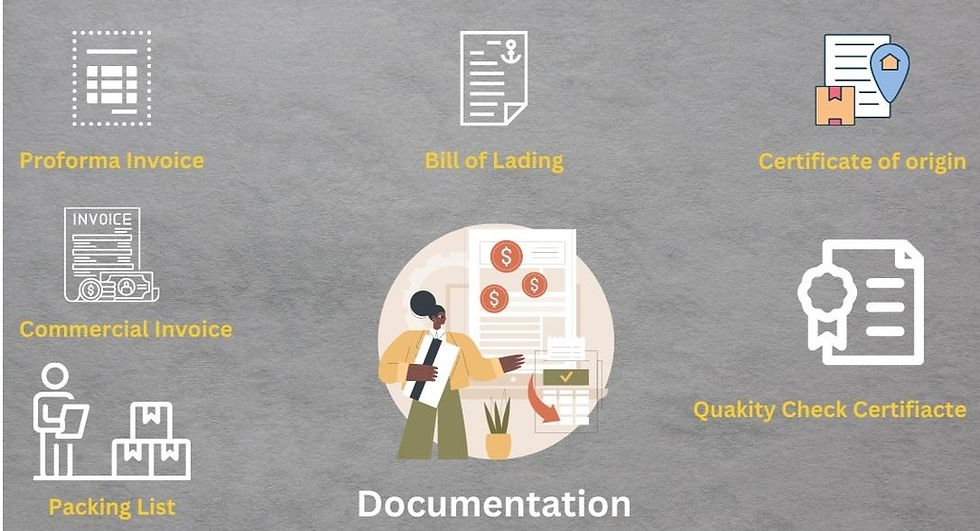

9) What are the Documents required for Export Consignment?

Proforma Invoice is the document that is required when a supplier wants to have his advance payment from the buyer on an agreed payment term (LC or Certain % advance rest after Scanned BL) Proforma invoice must have the below-mentioned list of content.

Buyer details and shipper details

A detailed description of goods or service

The HS Code (Harmonized System classification Code) of those goods or services.

Agreed Price

Agreed on Incoterms

Agreed to payment terms.

The Purchase order number

Currency of agreed commercial.

A commercial Invoice is a document that is required at the time of shipment, it comprises almost all the detail of the export shipment. it also has all the details as mentioned in the proforma invoice. It is the Key document for customs. without a sign from shippers' county customs, they can not the shipment to another country.

Packing List is a document that is required when the cargo contains one or more than one items. A proper packaging list indicates how many cartons or Boxes are being shipped by the supplier's help the freight forwarder prepare the Bill of Lading.

A Shipping Bill or Bill of Export is a document that is required by a freight forwarder to load the shipment on the vessel or Cargo flights, this document is issued by the Indian Customs Electronic Gateway (ICEGATE) which provides electronic filing of Shipping Bills. A supplier cannot ship the goods unless and until he files the Shipping Bill. your AD is a must for generating the shipping bill it also appears on the same.

Certificates of Origin are the document required by not all countries but in a few countries. A certificate of origin to identify in what country the goods originated. A Certificate of Origin is issued by both the ICC (Indian Chamber of Commerce) as well as TPCI (Trade Promotion Council of India). It is a government affidavit attached to the commercial invoice.

Bill of Lading (BL) is one of the essential documents issued by the Freight forwarder (Shipping Company) (Air or Sea) that represents a contract and a receipt between the shipper and the freight forwarder. Under this Bill, the shipping company acknowledges that the goods have been received from the exporter in good condition and are ready to ship.

Phyto-sanitary certificates and fumigation certificates in cases of exporting an agricultural product the Phyto-sanitary certificate and the fumigation certificate are two most essential documents that are demanded by the importer regarding the quality check of products under international quality standards and norms. The Quality demanded under this certification eventually help exporter to maintain the quality of the goods during the transit.

10) Caution for exporting your first shipment?

Documentation in exports plays a very big role, so if you are exporting for the first time try to avoid doing it yourself rather than take the help of a consultant or an experienced exporter, also take the help of a custom house agent for avoiding any type of issues.

Buyer verification must be done properly to avoid any kind of future losses.

RCMC is a must-have document even if it is not mandatory it helps you to mitigate the risks related to the export shipment.

Payment terms should be properly negotiated if you are exporting for the first time it should be one from the safe payment terms.

For Exporting Hazardous or restricted material as per Indian customs you need to have the proper approval from the DGFT office.

Comentarios